Presumably from the other 7 countries not on the graph that must have negative figures.thatdberight wrote:I'm not really interested but if all those figures are positive, where are they all coming from?

Offshore Tax Avoidance: Mike Garlick

-

nil_desperandum

- Posts: 7653

- Joined: Thu Jan 21, 2016 5:06 pm

- Been Liked: 1917 times

- Has Liked: 4254 times

Re: Offshore Tax Avoidance: Mike Garlick

-

RingoMcCartney

- Posts: 10318

- Joined: Sat Apr 02, 2016 4:45 pm

- Been Liked: 2637 times

- Has Liked: 2798 times

Re: Offshore Tax Avoidance: Mike Garlick

If it be your will wrote:See? Take out all the hate and gloating, and you can actually make a really good point. I should say, though, that this could work both ways. If the UK enters a serious downturn, it will be unemployed British workers suppressing wages in France, Denmark, Germany, Spain...

Immigrants moving thousands of miles to work here aren't nasty people, and most probably would rather have stayed where they were. The key to all this is to stop humans being used as flexible, servile, transportable economic units serving the markets. Hating immigrants achieves nothing. I actually quite like Poles and Bulgarians, truth be told.

"Hating immigrants achieves nothing."

There is a difference between being concerned about the EFFECTS of uncontrolled mass immigration. And.

Hating immigrants.

Re: Offshore Tax Avoidance: Mike Garlick

It's showing absolute immigration, not net.thatdberight wrote:I'm not really interested but if all those figures are positive, where are they all coming from?

-

thatdberight

- Posts: 3748

- Joined: Mon Mar 20, 2017 9:49 am

- Been Liked: 937 times

- Has Liked: 716 times

Re: Offshore Tax Avoidance: Mike Garlick

Thanks. It's not really very useful then.aggi wrote:It's showing absolute immigration, not net.

-

If it be your will

- Posts: 2103

- Joined: Tue Apr 19, 2016 10:12 am

- Been Liked: 500 times

- Has Liked: 509 times

Re: Offshore Tax Avoidance: Mike Garlick

.

Last edited by If it be your will on Sat Oct 06, 2018 8:47 pm, edited 1 time in total.

Re: Offshore Tax Avoidance: Mike Garlick

It's got some interesting stuff in there, for instance I was surprised by the level of non-EU immigration into Germany.

In the context of the discussion though, Ringo is very definite that the fall in wages in real terms was solely to do with immigration (still waiting for that evidence by the way Ringo) so I presented a table of immigration levels.

In the context of the discussion though, Ringo is very definite that the fall in wages in real terms was solely to do with immigration (still waiting for that evidence by the way Ringo) so I presented a table of immigration levels.

-

CrosspoolClarets

- Posts: 6747

- Joined: Thu Jan 21, 2016 9:00 pm

- Been Liked: 1973 times

- Has Liked: 504 times

Re: Offshore Tax Avoidance: Mike Garlick

Revisiting this thread, the immigration table makes perfect sense, you would expect Germany at the top, because Germany have plunging demographics and desparately need migrants, hence the EUs migrant policy as a whole. They need migrants, we do not (not at those levels anyway). Big difference.

Germany’s exceptional productivity leads to high real terms wages despite the migration figures, our poor productivity (made worse by the low interest rate culture, banks not lending since 2008, then banks not shutting down poor businesses) is then excacerbated by the migration to lead to stagnating real terms wages for ordinary people. All hard to prove without a detailed economic model but I believe this is the case.

Anyway, the real reason I logged back on was to share this report by Woodford Investment Management (the UKs most famous fund manager) out today. They got Capital Economics to revisit a report they did 18 months ago. Capital are more pro Brexit, but I agree with them. The report is excellent, and positive.

https://woodfordfunds.com/brexit/where-are-we-now/

Germany’s exceptional productivity leads to high real terms wages despite the migration figures, our poor productivity (made worse by the low interest rate culture, banks not lending since 2008, then banks not shutting down poor businesses) is then excacerbated by the migration to lead to stagnating real terms wages for ordinary people. All hard to prove without a detailed economic model but I believe this is the case.

Anyway, the real reason I logged back on was to share this report by Woodford Investment Management (the UKs most famous fund manager) out today. They got Capital Economics to revisit a report they did 18 months ago. Capital are more pro Brexit, but I agree with them. The report is excellent, and positive.

https://woodfordfunds.com/brexit/where-are-we-now/

-

Rowls

- Posts: 14659

- Joined: Wed Jan 20, 2016 11:00 pm

- Been Liked: 5646 times

- Has Liked: 5875 times

- Location: Montpellier, France

Re: Offshore Tax Avoidance: Mike Garlick

The law is designed to take take when tax is due.Spijed wrote:The law is simply designed to help the wealthiest avoid paying as much tax as possible!

Still, money is everything to the wealthiest.

Morality means nothing.

Money means far less to the wealthiest for the very fact that they have a surplus of it. It only "means" to people with little money or ambitions for more money.

Morality here is a non-sequitur.

This user liked this post: fatboy47

Re: Offshore Tax Avoidance: Mike Garlick

Ah, that’ll be why the wealthy go to such lengths to avoid paying tax then.Rowls wrote:The law is designed to take take when tax is due.

Money means far less to the wealthiest for the very fact that they have a surplus of it.

These 2 users liked this post: If it be your will longsidepies

Re: Offshore Tax Avoidance: Mike Garlick

Neil Woodford has been losing quite a bit of credibility over the last year or so, as his Equity Income fund has disappointed massively and has been 4th quartile in that time. He's dropped some major ******** with Provident and AstraZeneca, to the extent that I got a letter from one of my pension providers at the weekend telling me they're dropping this fund from their carried funds.CrosspoolClarets wrote:

Anyway, the real reason I logged back on was to share this report by Woodford Investment Management (the UKs most famous fund manager) out today. They got Capital Economics to revisit a report they did 18 months ago. Capital are more pro Brexit, but I agree with them. The report is excellent, and positive.

https://woodfordfunds.com/brexit/where-are-we-now/

The charts for the cumulative and discrete performance are shocking, and the type you'd see from a fresh-faced kid handed his first fund.

It'll be interesting to see if his appearance at an industry event tonight goes swimmingly, because there'll be a few people there who've lost decent money with him.

-

fatboy47

- Posts: 5301

- Joined: Thu Jan 21, 2016 8:58 am

- Been Liked: 2852 times

- Has Liked: 3210 times

- Location: Isles of Scilly

Re: Offshore Tax Avoidance: Mike Garlick

Tend to agree with Rowls.....money was a big issue for me when I had nowt...don't give it a second thought these days..I have people to keep an eye on that crap.

Re: Offshore Tax Avoidance: Mike Garlick

The wealthiest tend to become the wealthiest because they have ambitions for more money.Rowls wrote:The law is designed to take take when tax is due.

Money means far less to the wealthiest for the very fact that they have a surplus of it. It only "means" to people with little money or ambitions for more money.

Morality here is a non-sequitur.

Try dealing with UHNWIs on a regular basis and you'll soon discover that having lots of money has no relation to how much it "means" to people.

Re: Offshore Tax Avoidance: Mike Garlick

The Woodford Funds analysis is interesting, although fairly simplistic (I don't know if there is a full document somewhere or just the business sector summaries and backing analysis). As others have also mentioned, although Neil Woodford may be arguably the most famous fund manager he is a way off being the best performing or influential and is particularly struggling at the moment.

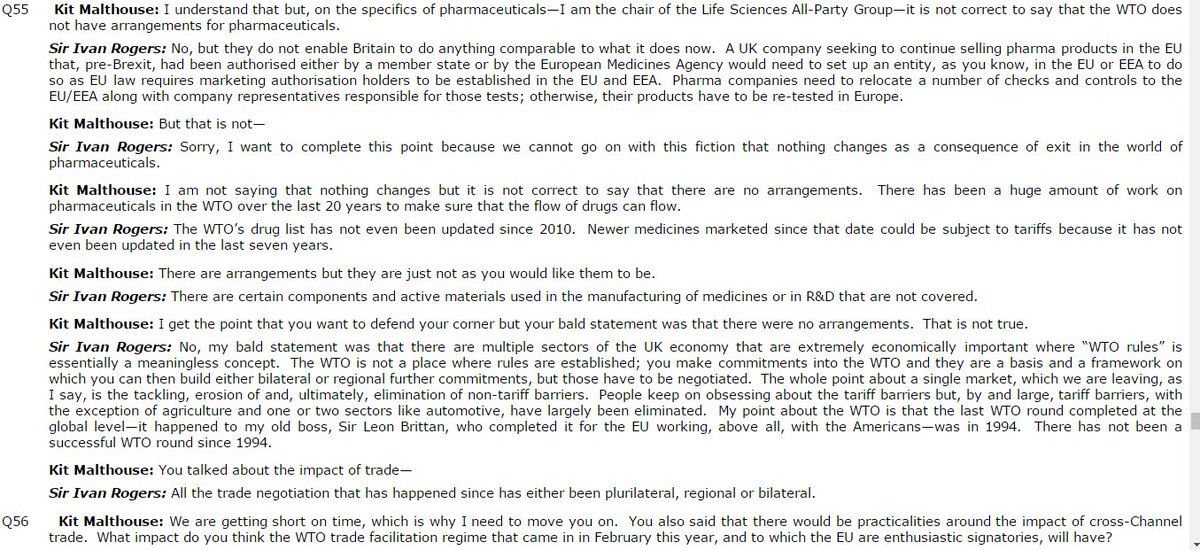

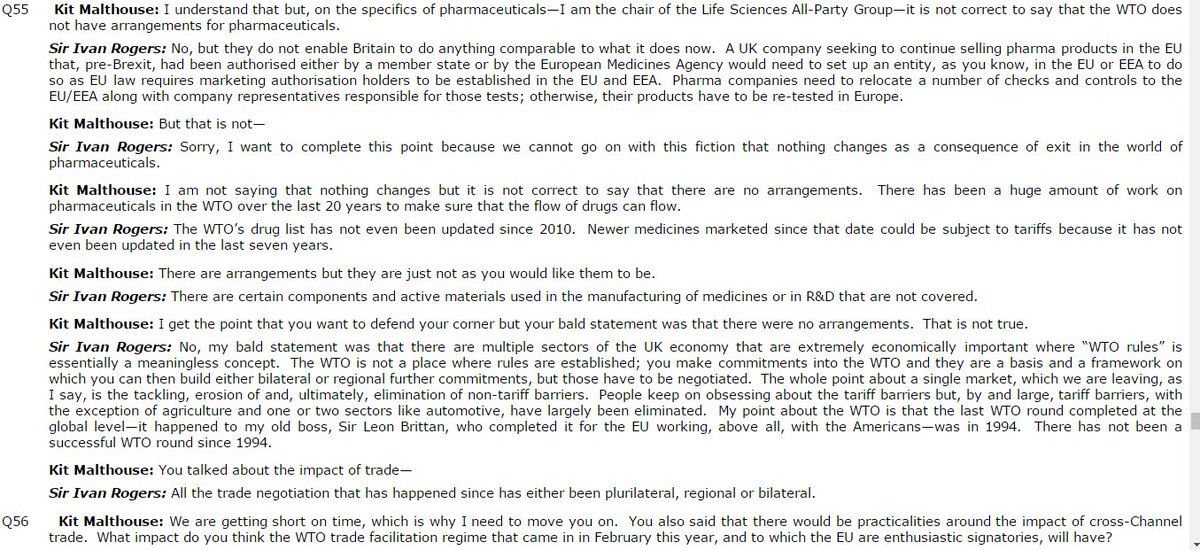

It seems a little optimistic, comparing the life sciences section to this discussion between Sir Ivan Rogers and a committee of MPs for instance gives a distinctly different slant.

However, even assuming the report is accurate, the greater concern is how likely are we to negotiate those best-case scenarios. Brexit may not have been too bad if we'd gone into it with a competent, all-party team. As it is there's a party clinging to power by its fingertips trying to keep power first and negotiate second and a party on the other side trying to disrupt them at any cost. It's all a bit of a shambles.

Anyway, back to tax avoidance. It's interesting that a lot of the ire is directed towards people like the Mrs Brown's Boys "stars" who have taken part in some dubious schemes. However, you have got to ponder how much blame can be attached to them as opposed to their advisers. You're paying professional advisers to look after your money, if they recommend you make use of a scheme and assure you that it is legal then how are you going to know otherwise? You're an actor, not a tax expert.

It seems a little optimistic, comparing the life sciences section to this discussion between Sir Ivan Rogers and a committee of MPs for instance gives a distinctly different slant.

However, even assuming the report is accurate, the greater concern is how likely are we to negotiate those best-case scenarios. Brexit may not have been too bad if we'd gone into it with a competent, all-party team. As it is there's a party clinging to power by its fingertips trying to keep power first and negotiate second and a party on the other side trying to disrupt them at any cost. It's all a bit of a shambles.

Anyway, back to tax avoidance. It's interesting that a lot of the ire is directed towards people like the Mrs Brown's Boys "stars" who have taken part in some dubious schemes. However, you have got to ponder how much blame can be attached to them as opposed to their advisers. You're paying professional advisers to look after your money, if they recommend you make use of a scheme and assure you that it is legal then how are you going to know otherwise? You're an actor, not a tax expert.

-

UpTheBeehole

- Posts: 5069

- Joined: Thu Apr 13, 2017 3:14 pm

- Been Liked: 1157 times

- Has Liked: 496 times

Re: Offshore Tax Avoidance: Mike Garlick

Capital Economics, who wrote crosspool's linked report, are long-term eurosceptics and have previously published a paper on how the Eurozone could be dismantled.

Its founder wrote 'The Trouble with Europe: Why the EU Isn't Working, How It Can Be Reformed, What Could Take Its Place'.

Another of the directors is a writer for BrexitCentral.com http://brexitcentral.com/author/julian-jessop/

Of the authors, Melanie Delbono is on record pre-referendum as being pro brexit and Glyn Chambers is a failed Tory PPC

It's hardly coming from a balanced perspective is it?

Its founder wrote 'The Trouble with Europe: Why the EU Isn't Working, How It Can Be Reformed, What Could Take Its Place'.

Another of the directors is a writer for BrexitCentral.com http://brexitcentral.com/author/julian-jessop/

Of the authors, Melanie Delbono is on record pre-referendum as being pro brexit and Glyn Chambers is a failed Tory PPC

It's hardly coming from a balanced perspective is it?

-

If it be your will

- Posts: 2103

- Joined: Tue Apr 19, 2016 10:12 am

- Been Liked: 500 times

- Has Liked: 509 times

Re: Offshore Tax Avoidance: Mike Garlick

.

Last edited by If it be your will on Sat Oct 06, 2018 8:48 pm, edited 1 time in total.

Re: Offshore Tax Avoidance: Mike Garlick

https://www.theguardian.com/news/2017/n ... are_btn_tw" onclick="window.open(this.href);return false;evensteadiereddie wrote:All those critics of Lineker seem to have gone mighty quiet.............

-

evensteadiereddie

- Posts: 9811

- Joined: Thu Jan 21, 2016 9:45 pm

- Been Liked: 3226 times

- Has Liked: 10705 times

- Location: Staffordshire

Re: Offshore Tax Avoidance: Mike Garlick

As the article says re Lineker's tax avoidance .."a method that has legal tax advantages".

It's avoidance, not evasion. All above board so nothing to see here, really.

If we want to criticise anybody over these schemes, it's our useless Parliament which, for several reasons, will continue to permit this nonsense to go on, not having the balls to close these loopholes where they can.

It's avoidance, not evasion. All above board so nothing to see here, really.

If we want to criticise anybody over these schemes, it's our useless Parliament which, for several reasons, will continue to permit this nonsense to go on, not having the balls to close these loopholes where they can.

Re: Offshore Tax Avoidance: Mike Garlick

Yeah nothing to see here because Gary always pays what he is dueevensteadiereddie wrote:As the article says re Lineker's tax avoidance .."a method that has legal tax advantages".

It's avoidance, not evasion. All above board so nothing to see here, really.

If we want to criticise anybody over these schemes, it's our useless Parliament which, for several reasons, will continue to permit this nonsense to go on, not having the balls to close these loopholes where they can.

P Except when he is using complex systems to make his tax dealings legal.

He is typical of the celebrity left.

I.e a massive hypocrite

This user liked this post: LeadBelly

-

Lancasterclaret

- Posts: 23343

- Joined: Thu Jan 21, 2016 2:09 pm

- Been Liked: 8058 times

- Has Liked: 4714 times

- Location: Riding the galactic winds in my X-wing

Re: Offshore Tax Avoidance: Mike Garlick

No difference to Farage Damo

I see the difference between "avoidance" and "evasion" doesn't sink in when people are trying to make political points.

I see the difference between "avoidance" and "evasion" doesn't sink in when people are trying to make political points.

-

CrosspoolClarets

- Posts: 6747

- Joined: Thu Jan 21, 2016 9:00 pm

- Been Liked: 1973 times

- Has Liked: 504 times

Re: Offshore Tax Avoidance: Mike Garlick

UpTheBeehole wrote:Capital Economics, who wrote crosspool's linked report, are long-term eurosceptics and have previously published a paper on how the Eurozone could be dismantled.

In regard to these two comments from earlier, economists tend to have nailed their colours to the mast about the EU long ago, so are either fervent supporters or sceptical. I suppose it depends on the view each has of protectionism, single currencies and the likes. Capital lean more free market, others like the OECD are polar opposites. We all have to read reports through that prism. The Woodford full report is currently being printed onto PDF form, I will be getting it emailed when it is fully out.aggi wrote:The Woodford Funds analysis is interesting, although fairly simplistic (I don't know if there is a full document somewhere or just the business sector summaries and backing analysis). As others have also mentioned, although Neil Woodford may be arguably the most famous fund manager he is a way off being the best performing or influential and is particularly struggling at the moment.

Regarding Woodford and his stock performance, this is again a judgement on perspective. For the vast bulk of the last decade I have made naff all from my investments because I never trusted that they would thrive in a world of low growth, high debt and low inflation. Turns out QE and near zero interest rates have blown up a huge bubble. I was wrong (though because I’m not certifiably insane I’m not jumping back in now). Woodford isn’t the type to have jumped on that bandwagon either. If this bubble bursts, I would back Woodford again.

-

CrosspoolClarets

- Posts: 6747

- Joined: Thu Jan 21, 2016 9:00 pm

- Been Liked: 1973 times

- Has Liked: 504 times

Re: Offshore Tax Avoidance: Mike Garlick

Article here in Jersey tonight in the Evening Post from a top lawyer, advising that due to trends around the world avoidance will soon be viewed the same way as evasion, and Jersey had better diversify. I agree with him.Lancasterclaret wrote:No difference to Farage Damo

I see the difference between "avoidance" and "evasion" doesn't sink in when people are trying to make political points.

-

LeadBelly

- Posts: 4604

- Joined: Fri Jan 22, 2016 11:07 am

- Been Liked: 1069 times

- Has Liked: 2267 times

- Location: North Hampshire

Re: Offshore Tax Avoidance: Mike Garlick

Yes there's a legal difference between avoidance & evasion but when a sanctimonious person is avoiding, it marks them out as a "do as I say and not as I do" merchant. Whatever the legalities.

Bono, & Saint Gary (& probably Charley boy) are prime examples.

Bono, & Saint Gary (& probably Charley boy) are prime examples.

Re: Offshore Tax Avoidance: Mike Garlick

Yes, but "avoidance" includes putting your savings into an ISA. Lineker-like avoidance is being pursued by governments generally, so high-end avoidance will become evasion as the law changes; but they're going to struggle (as with the general law mentioned earlier) to say that something is not taxable in law but is taxable in practice.CrosspoolClarets wrote:Article here in Jersey tonight in the Evening Post from a top lawyer, advising that due to trends around the world avoidance will soon be viewed the same way as evasion, and Jersey had better diversify. I agree with him.

-

Lancasterclaret

- Posts: 23343

- Joined: Thu Jan 21, 2016 2:09 pm

- Been Liked: 8058 times

- Has Liked: 4714 times

- Location: Riding the galactic winds in my X-wing

Re: Offshore Tax Avoidance: Mike Garlick

I agree with him as well, but the international efforts to combat tax evasion are always behind the lawyers and the super accountants so it will take time.Article here in Jersey tonight in the Evening Post from a top lawyer, advising that due to trends around the world avoidance will soon be viewed the same way as evasion, and Jersey had better diversify. I agree with him.

Re: Offshore Tax Avoidance: Mike Garlick

I havent seen a post on here defending farage. And I wouldn't expect to. I only commented to highlight Gary virtue signallers hypocrisy.Lancasterclaret wrote:No difference to Farage Damo

I see the difference between "avoidance" and "evasion" doesn't sink in when people are trying to make political points.

Feel free to slate Nigel pal

-

Lancasterclaret

- Posts: 23343

- Joined: Thu Jan 21, 2016 2:09 pm

- Been Liked: 8058 times

- Has Liked: 4714 times

- Location: Riding the galactic winds in my X-wing

Re: Offshore Tax Avoidance: Mike Garlick

Come off it Damo

And "virtue signalling"?

Please, you are better than that

And "virtue signalling"?

Please, you are better than that

Re: Offshore Tax Avoidance: Mike Garlick

As far as virtue signalling goes, he is the absolute king. Lily Allen is the only person as hypocritical as him that I can think ofLancasterclaret wrote:Come off it Damo

And "virtue signalling"?

Please, you are better than that

-

Lancasterclaret

- Posts: 23343

- Joined: Thu Jan 21, 2016 2:09 pm

- Been Liked: 8058 times

- Has Liked: 4714 times

- Location: Riding the galactic winds in my X-wing

Re: Offshore Tax Avoidance: Mike Garlick

Glad I went to bed when I did!

You are using "virtue signalling" when you should be saying "using the fact that lots of people listen to him to highlight problems that an awful lot of us tend to ignore"

Or

"gives a **** about people other than himself"

You are using "virtue signalling" when you should be saying "using the fact that lots of people listen to him to highlight problems that an awful lot of us tend to ignore"

Or

"gives a **** about people other than himself"

-

claretandy

- Posts: 4751

- Joined: Thu Jan 21, 2016 12:47 pm

- Been Liked: 953 times

- Has Liked: 238 times

Re: Offshore Tax Avoidance: Mike Garlick

While avoiding paying his taxes, finished that off for you.Lancasterclaret wrote:Glad I went to bed when I did!

You are using "virtue signalling" when you should be saying "using the fact that lots of people listen to him to highlight problems that an awful lot of us tend to ignore"

Or

"gives a **** about people other than himself"

I would say that qualifies him as a virtue signaler.

-

Lancasterclaret

- Posts: 23343

- Joined: Thu Jan 21, 2016 2:09 pm

- Been Liked: 8058 times

- Has Liked: 4714 times

- Location: Riding the galactic winds in my X-wing

Re: Offshore Tax Avoidance: Mike Garlick

Wow, there is a shock. You think Gary Lineker, who regularly blows away people with exactly your opinions on twitter, is a "virtue signaller"

I would say that you will avoid paying tax, as do I, as does everyone.

I don't know what he spends his money on either btw, but he certainly does a lot more work of charities than you and I do.

That kinda would make him something different to a "virtue signaller" surely?

I mean, surely you can't be calling him that just because he stands for stuff that you don't?

I would say that you will avoid paying tax, as do I, as does everyone.

I don't know what he spends his money on either btw, but he certainly does a lot more work of charities than you and I do.

That kinda would make him something different to a "virtue signaller" surely?

I mean, surely you can't be calling him that just because he stands for stuff that you don't?

-

deanothedino

- Posts: 1711

- Joined: Thu Aug 17, 2017 10:34 am

- Been Liked: 741 times

- Has Liked: 381 times

Re: Offshore Tax Avoidance: Mike Garlick

If you pay into a company pension, you are probably a tax avoider. If you bought anything on a cycle to work scheme, you're a tax avoider. If you get childcare vouchers through work...

People seem to forget all of these things conveniently when someone famous has legally lowered their tax bill.

I always find the line "The state punishes benefit fraudsters more then it does tax avoiders", maybe that is because benefit fraud is illegal and not paying tax you don't have to isn't.

Now the real shame is that rich people in the 21st century aren't like rich people of the early 1900s. Can you imagine someone giving a large sum to a council to build something like the Thompson Centre in this day and age? If they did things like that people would probably be a lot less upset that they legally avoid paying some tax.

People seem to forget all of these things conveniently when someone famous has legally lowered their tax bill.

I always find the line "The state punishes benefit fraudsters more then it does tax avoiders", maybe that is because benefit fraud is illegal and not paying tax you don't have to isn't.

Now the real shame is that rich people in the 21st century aren't like rich people of the early 1900s. Can you imagine someone giving a large sum to a council to build something like the Thompson Centre in this day and age? If they did things like that people would probably be a lot less upset that they legally avoid paying some tax.

Re: Offshore Tax Avoidance: Mike Garlick

I read up a little on the Gary Lineker tax avoidance that has cropped up on the Paradise Papers. If I was his professional adviser I would have very strongly recommended him to take the route that he did. Not only for the tax savings but mainly because at that point there were procedures in place that made it very difficult to get your money out of the country if you sold as an individual as opposed to an overseas company.

-

Rick_Muller

- Posts: 6786

- Joined: Thu Jan 21, 2016 8:53 am

- Been Liked: 2856 times

- Has Liked: 7024 times

- Location: -90.000000, 0.000000

Re: Offshore Tax Avoidance: Mike Garlick

I'm sorry but comparing Company Pensions; ISAs; Childcare vouchers and other government incentives that happen to involve a reduction in tax to elaborate schemes for the rich to avoid paying tax that would be due by any normal person is a bit stupid, and people who cannot distinguish between a government incentive and a tax avoidance scheme really need to wake up and realise what the differences are.deanothedino wrote:If you pay into a company pension, you are probably a tax avoider. If you bought anything on a cycle to work scheme, you're a tax avoider. If you get childcare vouchers through work...

People seem to forget all of these things conveniently when someone famous has legally lowered their tax bill.

I always find the line "The state punishes benefit fraudsters more then it does tax avoiders", maybe that is because benefit fraud is illegal and not paying tax you don't have to isn't.

Now the real shame is that rich people in the 21st century aren't like rich people of the early 1900s. Can you imagine someone giving a large sum to a council to build something like the Thompson Centre in this day and age? If they did things like that people would probably be a lot less upset that they legally avoid paying some tax.

-

deanothedino

- Posts: 1711

- Joined: Thu Aug 17, 2017 10:34 am

- Been Liked: 741 times

- Has Liked: 381 times

Re: Offshore Tax Avoidance: Mike Garlick

So, if PAYE didn't exist you wouldn't try and minimise what you pay in tax any further through entirely legal means? The only real difference is that the government advertises and tells you how to do one, and doesn't stop you doing the other.Rick_Muller wrote:I'm sorry but comparing Company Pensions; ISAs; Childcare vouchers and other government incentives that happen to involve a reduction in tax to elaborate schemes for the rich to avoid paying tax that would be due by any normal person is a bit stupid, and people who cannot distinguish between a government incentive and a tax avoidance scheme really need to wake up and realise what the differences are.

I bet there's more than a few posters on here who contract, I'd imagine all of them are legally minimising what they pay in taxes too.

The differences are what your payroll enables you as an individual to do. If you can't see that, then I think you're incredibly naive.

-

RingoMcCartney

- Posts: 10318

- Joined: Sat Apr 02, 2016 4:45 pm

- Been Liked: 2637 times

- Has Liked: 2798 times

Re: Offshore Tax Avoidance: Mike Garlick

Gary Lineker, the multi millionaire, can afford to avail himself of advisors, who help him avoid paying tax.

I wish I could afford, to avail myself of similar advice, on avoiding prison. For not paying the BBC poll tax. AKA the TV licence fee.

I wish I could afford, to avail myself of similar advice, on avoiding prison. For not paying the BBC poll tax. AKA the TV licence fee.

This user liked this post: Rick_Muller

-

Rick_Muller

- Posts: 6786

- Joined: Thu Jan 21, 2016 8:53 am

- Been Liked: 2856 times

- Has Liked: 7024 times

- Location: -90.000000, 0.000000

Re: Offshore Tax Avoidance: Mike Garlick

I'm not naive at all. I am fed up with people comparing what the majority of the population have to do in many instances (PAYE), and the government incentives (pensions; childcare vouchers etc) which happen to include a reduction in tax payable to the likes of Lewis Hamilton who has both the funds and the means to avoid paying VAT on a private jet - there is no comparison at all and anyone who keeps stating that there is are either benefiting from similar schemes or they are too thick to know the difference.deanothedino wrote: then I think you're incredibly naive.

I am fully aware of contractors who do their best to earn a good living, I know plenty in the IT industry. Again, comparing these people who fall outside of company PAYE schemes and have to do their own tax returns (probably paying an accountant to help) with Mrs Browns Boys who use an offshore company in Mauritius to avoid paying the tax due is, again, quite a bit disingenuous dont you think...?

And if you ask me whether I would do the same as the rich and famous given the opportunity my answer would be "NO" - because I see the benefit to society in paying my way and paying what is due.

-

UpTheBeehole

- Posts: 5069

- Joined: Thu Apr 13, 2017 3:14 pm

- Been Liked: 1157 times

- Has Liked: 496 times

Re: Offshore Tax Avoidance: Mike Garlick

You can protect yourself against going to prison for just £12.25 per month.RingoMcCartney wrote:Gary Lineker, the multi millionaire, can afford to avail himself of advisors, who help him avoid paying tax.

I wish I could afford, to avail myself of similar advice, on avoiding prison. For not paying the BBC poll tax. AKA the TV licence fee.

Very, very affordable legal protection.

Re: Offshore Tax Avoidance: Mike Garlick

Something I agree with. It's all well and good many on here saying that people are only doing what they are entitled to do and avoid paying tax in certain situations, such as Mike Garlick does, but they have the resources to look at ways to avoid paying tax.RingoMcCartney wrote:Gary Lineker, the multi millionaire, can afford to avail himself of advisors, who help him avoid paying tax.

I wish I was wealthy enough, to avail myself on avoiding prison, for not paying the BBC poll tax. AKA the TV licence fee.

Many other people don't. It might be legally correct what thousands of people do, but in terms of morality it's a long way down the scale!

Re: Offshore Tax Avoidance: Mike Garlick

I can advise you on how to avoid the requirement to pay the licence fee. I'll only charge you £100 for this advice.RingoMcCartney wrote:Gary Lineker, the multi millionaire, can afford to avail himself of advisors, who help him avoid paying tax.

I wish I could afford, to avail myself of similar advice, on avoiding prison. For not paying the BBC poll tax. AKA the TV licence fee.

This user liked this post: Rick_Muller

-

RingoMcCartney

- Posts: 10318

- Joined: Sat Apr 02, 2016 4:45 pm

- Been Liked: 2637 times

- Has Liked: 2798 times

Re: Offshore Tax Avoidance: Mike Garlick

That's NOT actually advice on avoiding prison for non payment of the BBC poll tax. Something that's contributed to the tax avoider, Lineker, becoming a multi millionaire.UpTheBeehole wrote:You can protect yourself against going to prison for just £12.25 per month.

Very, very affordable legal protection.

That's actually paying the BBC poll tax.

Let me give you some advice. Don't try to give people advice if you clearly don't understand the remit!!!

-

deanothedino

- Posts: 1711

- Joined: Thu Aug 17, 2017 10:34 am

- Been Liked: 741 times

- Has Liked: 381 times

Re: Offshore Tax Avoidance: Mike Garlick

At what level does it become unacceptable then? You appear to say that it is okay for your mates in the IT industry to avoid some tax, bearing in mind contractors are paid more to account for the benefits their PAYE colleagues get that they do not, but it isn't for the cast of Mrs Brown's Boys. Where do you draw the line?Rick_Muller wrote:I'm not naive at all. I am fed up with people comparing what the majority of the population have to do in many instances (PAYE), and the government incentives (pensions; childcare vouchers etc) which happen to include a reduction in tax payable to the likes of Lewis Hamilton who has both the funds and the means to avoid paying VAT on a private jet - there is no comparison at all and anyone who keeps stating that there is are either benefiting from similar schemes or they are too thick to know the difference.

I am fully aware of contractors who do their best to earn a good living, I know plenty in the IT industry. Again, comparing these people who fall outside of company PAYE schemes and have to do their own tax returns (probably paying an accountant to help) with Mrs Browns Boys who use an offshore company in Mauritius to avoid paying the tax due is, again, quite a bit disingenuous dont you think...?

And if you ask me whether I would do the same as the rich and famous given the opportunity my answer would be "NO" - because I see the benefit to society in paying my way and paying what is due.

So, no I don't think it is disingenuous as it is all to do with scale. As they earn more their capacity to avoid tax grows. As I said in my original post, if the rich and famous were more philanthropic at a local level would them legally avoiding tax be as big of an issue? I don't think so. The fact that they largely avoid a lot of tax to hoard or fritter is what makes it unpalatable.

-

Rick_Muller

- Posts: 6786

- Joined: Thu Jan 21, 2016 8:53 am

- Been Liked: 2856 times

- Has Liked: 7024 times

- Location: -90.000000, 0.000000

Re: Offshore Tax Avoidance: Mike Garlick

Its OK for my IT contractor associates to use the tax law in this country to minimise their tax burden by normal means, but it's not OK for the cast of Mrs Browns Boys to create a "fictitious" company as a holding area to loan them money they dont have to pay back as a means of wilfully avoiding tax. I agree there is a grey area and some accountants will employ some means of avoidance that others wouldn't for "normal" people who dont fall under PAYE, but the case of Mrs Browns Boys is simply black and white I'm afraid and there is no comparison.deanothedino wrote:At what level does it become unacceptable then? You appear to say that it is okay for your mates in the IT industry to avoid some tax, bearing in mind contractors are paid more to account for the benefits their PAYE colleagues get that they do not, but it isn't for the cast of Mrs Brown's Boys. Where do you draw the line?

I think that is a valid point, the fact that there are some who just appear to gather wealth and do so by avoiding tax that would "normally" be due (i.e. income tax in the case of Mrs Browns Boys, or VAT in the case of Lewis Hamilton) and then when they have the wealth they may very well spunk it on snorting cocaine from the rear end of a prostitute in Vegas (totally fictitious example) is what grinds peoples gears.deanothedino wrote:The fact that they largely avoid a lot of tax to hoard or fritter is what makes it unpalatable.

-

If it be your will

- Posts: 2103

- Joined: Tue Apr 19, 2016 10:12 am

- Been Liked: 500 times

- Has Liked: 509 times

Re: Offshore Tax Avoidance: Mike Garlick

.

Last edited by If it be your will on Sat Oct 06, 2018 8:48 pm, edited 1 time in total.

Re: Offshore Tax Avoidance: Mike Garlick

I'll give you a bit of tax avoidance for free on this one. You just need to find a person aged 75 or more - it doesn't need to be a relative - and share your home with them. 100% efficient tax dodge!RingoMcCartney wrote:I wish I could afford, to avail myself of similar advice, on avoiding prison. For not paying the BBC poll tax. AKA the TV licence fee.

Re: Offshore Tax Avoidance: Mike Garlick

People like Lewis Hamilton or the cast of Mrs Brown's boys can afford advice on how to legally avoid tax. The majority of the public can't as it's not given out for free.

-

Lancasterclaret

- Posts: 23343

- Joined: Thu Jan 21, 2016 2:09 pm

- Been Liked: 8058 times

- Has Liked: 4714 times

- Location: Riding the galactic winds in my X-wing

Re: Offshore Tax Avoidance: Mike Garlick

Most accountants have a free first initial meeting.

If you are self-employed for starters you would be missing out if you didn't have one.

If you are self-employed for starters you would be missing out if you didn't have one.

Re: Offshore Tax Avoidance: Mike Garlick

My problem with Lineker, and what makes him a virtue signaller, is the fact he preaches one thing (something virtuous that makes him look like a really nice, ethical bloke) whilst doing something different (avoiding taxes, for example, like the people who he regularly slates.)

Re: Offshore Tax Avoidance: Mike Garlick

But how many accountants would be aware of the more complex 'off-shore' schemes that many celebs seem to use? Won't that require more work, which ultimately won't come cheap?Lancasterclaret wrote:Most accountants have a free first initial meeting.

If you are self-employed for starters you would be missing out if you didn't have one.