This Forum is the main messageboard to discuss all things Claret and Blue and beyond

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Fri Oct 06, 2023 8:08 pm

Paul Waine wrote: ↑Fri Oct 06, 2023 5:53 pm

Hi CP, can you give a bit more detail about "in excess of £200m?" Does this include £88 million share purchase in Kettering Capital Limited and the same £88 million share purchase in Calder Vale Holdings Limited? Thus only "in excess of £200m" because the numbers are counted twice, once in KCL and the second time in CVHL?

it is not difficult to see

£10m from ALK/VSL used to buy shares in Kettering Capital and then used again to buy shares in Calder Vale Holdings in December 2020

£88m the borrowed from the club (£65m of which the club borrowed from MSD) which was used to buy shares in Kettering Capital in December 2020

a further £26.8m borrowed from the club by CVHL between January 2021 and July 31 2022 (giving a total of £114.8m borrowed from the club as stated by the club in its last accounts)

all of the above monies appear to have been used to pay for shares in the club

£88m from ALK/VSL (we assume) used to buy a share in Kettering Capital and then reused to buy a share in Calder Vale Holdings in late September 2023

that is well in excess of £200m passing through these companies in a little under 3 years (not all went through Kettering Capital I was just grouping them for convenience)

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Fri Oct 06, 2023 8:14 pm

NewClaret wrote: ↑Fri Oct 06, 2023 8:04 pm

I’m surprised an £88 MILLION cash injection in the club has not garnered more discussion today!!!

we surmise it is going to the club, we do not know if it has or will - we know it is not yet going to by new shares in the club (a capital injection) as that would have to be made open to all shareholders so their holding is not diluted

dot forget there is the ringfenced shares still available to buy - about £20m with at the takeover price - some may see that as a better use of the money rather than a pay everything back at this time

-

NewClaret

- Posts: 17686

- Joined: Tue Dec 31, 2019 9:51 am

- Been Liked: 3980 times

- Has Liked: 4932 times

Post

by NewClaret » Fri Oct 06, 2023 8:19 pm

CP,

Tried to look back at your very helpful diagram earlier. Realise this is complex stuff so not going to try and ask you to explain it simply because I know it’s impossible. But…

“£88m borrowed from the club (£65m of which the club borrowed from MSD) which was used to buy shares in Kettering Capital in December 2020”

That sounds remarkably similar to todays cash injection?! Clearly not a coincidence. What’s the significance?

And is this external investment, do we know? Or will we ever? These CH filings are above my head.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Fri Oct 06, 2023 8:29 pm

NewClaret wrote: ↑Fri Oct 06, 2023 8:19 pm

CP,

Tried to look back at your very helpful diagram earlier. Realise this is complex stuff so not going to try and ask you to explain it simply because I know it’s impossible. But…

“£88m borrowed from the club (£65m of which the club borrowed from MSD) which was used to buy shares in Kettering Capital in December 2020”

That sounds remarkably similar to todays cash injection?! Clearly not a coincidence. What’s the significance?

And is this external investment, do we know? Or will we ever? These CH filings are above my head.

I suspect the numbers are a coincidence and probably have much more to do with whatever ALK/VSL have planned to do with the money - for example, if they buy the ringfenced shares they could force through a purchase from the remaining shareholders in the club. We know there is still a desire to buy more clubs and become a multi-club operation, there are plenty of possibilities for us to speculate about

I also suspect that ALK/VSL has one or more significant new investors - we may never know about that unless they actually tell us, because that is how that ownership group is structured

-

NewClaret

- Posts: 17686

- Joined: Tue Dec 31, 2019 9:51 am

- Been Liked: 3980 times

- Has Liked: 4932 times

Post

by NewClaret » Fri Oct 06, 2023 8:37 pm

Chester Perry wrote: ↑Fri Oct 06, 2023 8:14 pm

we surmise it is going to the club, we do not know if it has or will - we know it is not yet going to by new shares in the club (a capital injection) as that would have to be made open to all shareholders so their holding is not diluted

dot forget there is the ringfenced shares still available to buy - about £20m with at the takeover price - some may see that as a better use of the money rather than a pay everything back at this time

Surely a repayment of the debt they owe the club would mean a cash injection could be achieved without any change in the shareholdings at the club level?

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Fri Oct 06, 2023 8:47 pm

NewClaret wrote: ↑Fri Oct 06, 2023 8:37 pm

Surely a repayment of the debt they owe the club would mean a cash injection could be achieved without any change in the shareholdings at the club level?

It would, however not everyone believes that the intention is to repay the loans in this way - I have hoped but not been overly expectant to date

-

Nonayforever

- Posts: 3696

- Joined: Fri Jan 22, 2016 8:15 pm

- Been Liked: 791 times

- Has Liked: 185 times

Post

by Nonayforever » Fri Oct 06, 2023 9:17 pm

Been told by someone at the club that it's Middle East money not American.

When questioned wouldn't commit further.

Don't know what to make out of that as it's " against the grain".

-

JohnDearyMe

- Posts: 3047

- Joined: Fri Jan 29, 2016 2:31 pm

- Been Liked: 730 times

- Has Liked: 2393 times

Post

by JohnDearyMe » Fri Oct 06, 2023 9:43 pm

Nonayforever wrote: ↑Fri Oct 06, 2023 9:17 pm

Been told by someone at the club that it's Middle East money not American.

When questioned wouldn't commit further.

Don't know what to make out of that as it's " against the grain".

Elkashashy?!

-

IanMcL

- Posts: 34805

- Joined: Fri Jan 22, 2016 5:27 pm

- Been Liked: 6949 times

- Has Liked: 10368 times

Post

by IanMcL » Fri Oct 06, 2023 9:56 pm

I am a shareholder. Am I rich or broke?

Come on you Clarets.

-

NewClaret

- Posts: 17686

- Joined: Tue Dec 31, 2019 9:51 am

- Been Liked: 3980 times

- Has Liked: 4932 times

Post

by NewClaret » Fri Oct 06, 2023 10:35 pm

Nonayforever wrote: ↑Fri Oct 06, 2023 9:17 pm

Been told by someone at the club that it's Middle East money not American.

When questioned wouldn't commit further.

Don't know what to make out of that as it's " against the grain".

Out of interest, which Middle East states don’t currently have a stake/club in the PL?

Struggling to think who would want to invest from that region.

-

Vegas Claret

- Posts: 34911

- Joined: Fri Jan 22, 2016 4:00 am

- Been Liked: 12715 times

- Has Liked: 6322 times

- Location: clue is in the title

Post

by Vegas Claret » Fri Oct 06, 2023 11:12 pm

NewClaret wrote: ↑Fri Oct 06, 2023 10:35 pm

Out of interest, which Middle East states don’t currently have a stake/club in the PL?

Struggling to think who would want to invest from that region.

Oman ?

Not sure it matters, there are seemingly ways to get around everything when it comes to the PL and investing !

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Fri Oct 06, 2023 11:50 pm

Vegas Claret wrote: ↑Fri Oct 06, 2023 11:12 pm

Oman ?

Not sure it matters, there are seemingly ways to get around everything when it comes to the PL and investing !

add

Bahrain

Kuwait

Iraq

Qatar

Interestingly Kuwait's public investment fund is much bigger than that of Saudi Arabia

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Fri Oct 06, 2023 11:54 pm

I posted this on the MMT in July

Chester Perry wrote: ↑Sat Jul 29, 2023 9:43 am

Interesting piece in the Guardian today about Kuwait considering opening up its investment portfolio and become a more significant player on the regional and world stage - whether this materialises i part as football investment is at this stage just speculation

Could launch of sovereign fund make Kuwait the Gulf’s next football power?

Country with rich football history was at 1982 World Cup but has seen Saudi Arabia, the UAE and Qatar leave it behind

https://www.theguardian.com/football/20 ... ball-power

https://archive.is/GWDtN

-

Vegas Claret

- Posts: 34911

- Joined: Fri Jan 22, 2016 4:00 am

- Been Liked: 12715 times

- Has Liked: 6322 times

- Location: clue is in the title

Post

by Vegas Claret » Sat Oct 07, 2023 2:11 am

Chester Perry wrote: ↑Fri Oct 06, 2023 11:50 pm

add

Bahrain

Kuwait

Iraq

Qatar

Interestingly Kuwait's public investment fund is much bigger than that of Saudi Arabia

let's hope it's Kuwait then !!

Just want to add my thanks for all your hard work and the fact you explain stuff to those that ask, I don't understand half of it in it's normal delivered form so it's very helpful ! Cheers

This user liked this post: frankinwales

-

TPClaret

- Posts: 767

- Joined: Fri Jan 04, 2019 4:31 pm

- Been Liked: 279 times

Post

by TPClaret » Sat Oct 07, 2023 8:05 am

Obviously the reason Kompany chose to come to us and stick around.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 9:54 am

TPClaret wrote: ↑Sat Oct 07, 2023 8:05 am

Obviously the reason Kompany chose to come to us and stick around.

Almost all, the new investment monies in ALK/VSL have appeared since Vincent Kompany was engaged by the club, some would say he appears to be the catalyst for it, though there is a more than reasonable argument to say that the ownership group have created the environment for this interest and for Kompany to help the club to develop.

-

TPClaret

- Posts: 767

- Joined: Fri Jan 04, 2019 4:31 pm

- Been Liked: 279 times

Post

by TPClaret » Sat Oct 07, 2023 10:09 am

Chester Perry wrote: ↑Sat Oct 07, 2023 9:54 am

Almost all, the new investment monies in ALK/VSL have appeared since Vincent Kompany was engaged by the club, some would say he appears to be the catalyst for it, though there is a more than reasonable argument to say that the ownership group have created the environment for this interest and for Kompany to help the club to develop.

Do you think the investment would have come in with Dyche still the manager?

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 10:11 am

TPClaret wrote: ↑Sat Oct 07, 2023 10:09 am

Do you think the investment would have come in with Dyche still the manager?

We all know the answer to that - there is historical record under two ownership groups

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 10:54 am

Chester Perry wrote: ↑Fri Oct 06, 2023 3:14 pm

another 5 documents being processed at Calder Vale Holdings Limited

all related to the Capital injection, moving it to a reserve account, a solvency statement , a separate statement by the by the directors and the capital being restated and confirmation of all the new funds being removed from cthe Share Premium account

https://find-and-update.company-informa ... ng-history

similar happening at Kettering Capital too as you would expect

https://find-and-update.company-informa ... ng-history

still no sign of the first and second sets of accounts which are both substantially overdue

All these documents are now available to view

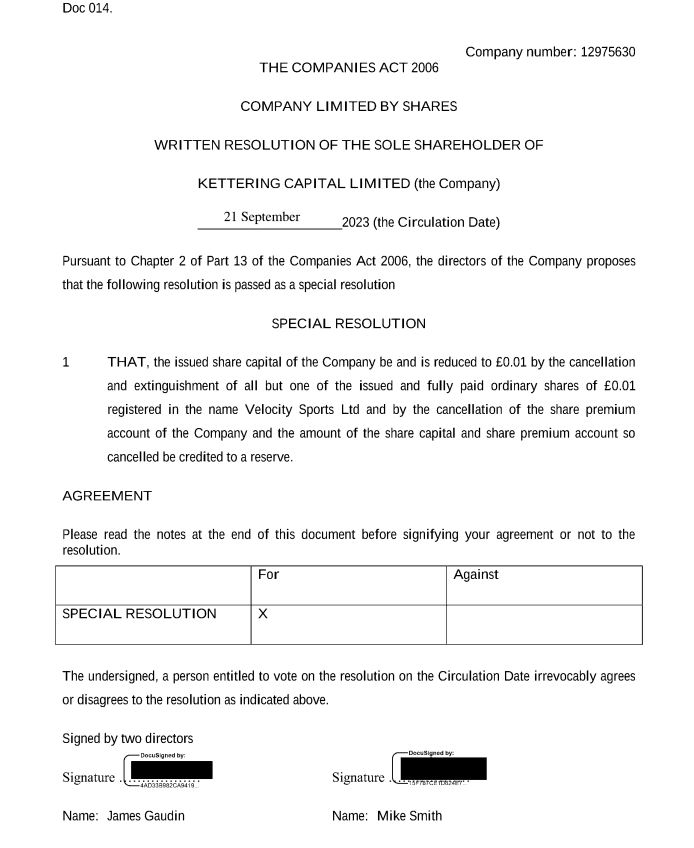

There is confirmation at Kettering Capital that the money has come from ALK/VSL via Velocity Sports Ltd (Jersey) interestingly that document is signed off by two directors of Velocity Sports Ltd - one of whom, James Gaudin is a name we have not come across before

- KCL Capital reduction.JPG (84.2 KiB) Viewed 4291 times

however a quick internet search reveals a James Gaudin who works for Appleby - you may remember that earlier this year we learned that Appleby Global Services were working as Company secretary for both of ALK's Jersey based operations

https://www.applebyglobal.com/people/james-gaudin/

-

Clive 1960

- Posts: 2056

- Joined: Tue Oct 18, 2022 10:15 am

- Been Liked: 299 times

- Has Liked: 568 times

Post

by Clive 1960 » Sat Oct 07, 2023 11:01 am

Chester Perry wrote: ↑Sat Oct 07, 2023 10:11 am

We all know the answer to that - there is historical record under two ownership groups

would it come as a surprise that it could be Mr Paces friend from China who was linked with us until he saw us play at Norwich who as invested.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 11:07 am

Clive 1960 wrote: ↑Sat Oct 07, 2023 11:01 am

would it come as a surprise that it could be Mr Paces friend from China who was linked with us until he saw us play at Norwich who as invested.

you have been clinging to this for a long time now - all the evidence of Chinese activity re football club investment in Europe over the last 5 years is either of exit (if face can be saved) or monies no longer forthcoming - it is unlikely China would sanction any company or individual to move so much money out of China to buy a share of a football club

This user liked this post: GodIsADeeJay81

-

Clive 1960

- Posts: 2056

- Joined: Tue Oct 18, 2022 10:15 am

- Been Liked: 299 times

- Has Liked: 568 times

Post

by Clive 1960 » Sat Oct 07, 2023 11:15 am

Chester Perry wrote: ↑Sat Oct 07, 2023 11:07 am

you have been clinging to this for a long time now - all the evidence of Chinese activity re football club investment in Europe over the last 5 years is either of exit (if face can be saved) or monies no longer forthcoming - it is unlikely China would sanction any company or individual to move so much money out of China to buy a share of a football club

Only because i live in Asia and it's been talked about, but we will have to wait and see m

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 11:17 am

Clive 1960 wrote: ↑Sat Oct 07, 2023 11:15 am

Only because i live in Asia and it's been talked about, but we will have to wait and see m

I am not saying it is impossible, just that it appears very unlikely given the historical evidence and trend

-

Ightenhill_Claret

- Posts: 389

- Joined: Fri Dec 30, 2022 4:14 pm

- Been Liked: 193 times

- Has Liked: 47 times

Post

by Ightenhill_Claret » Sat Oct 07, 2023 11:18 am

Thanks as ever Chester for your insight on these things. I’m confused by a document that’s appeared on Twitter just now (and it might be what you’ve just been posting about) -

https://x.com/kompany_ball/status/17105 ... PSJkgHMv9Q

I’m confused by the numbers - it looks like 1 share has been issues at a value of 0.01 but someone has paid £88m.

Can you simplify for those of us who are a little confused?

-

summitclaret

- Posts: 4568

- Joined: Thu Jan 21, 2016 12:39 pm

- Been Liked: 1021 times

- Has Liked: 1612 times

- Location: burnley

Post

by summitclaret » Sat Oct 07, 2023 11:21 am

Chester Perry wrote: ↑Sat Oct 07, 2023 11:07 am

you have been clinging to this for a long time now - all the evidence of Chinese activity re football club investment in Europe over the last 5 years is either of exit (if face can be saved) or monies no longer forthcoming - it is unlikely China would sanction any company or individual to move so much money out of China to buy a share of a football club

Hope your right CP.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 11:40 am

Ightenhill_Claret wrote: ↑Sat Oct 07, 2023 11:18 am

Thanks as ever Chester for your insight on these things. I’m confused by a document that’s appeared on Twitter just now (and it might be what you’ve just been posting about) -

https://x.com/kompany_ball/status/17105 ... PSJkgHMv9Q

I’m confused by the numbers - it looks like 1 share has been issues at a value of 0.01 but someone has paid £88m.

Can you simplify for those of us who are a little confused?

From what I am seeing - and aggi or one of the other accountants on here are probably better placed to say

A single share was bought for £88m - that money is legally required to got to a share premium account - following approval of shareholders (or their representatives) and submission of legal statements about solvency etc - the some has been transferred to a reserve account so it can be used for whatever purpose the directors of the company see fit,

So the Share Premium account has seen its balance effectively go from £88m to nil - this exercise has been repeated at Calder Vale Holdings

it is all above board and just the legal means of allowing the directors of the companies to spend the money in a manner they believe to be in the best interests of those businesses, Remember that that the only apparent activity of these businesses is their ownership of Burnley FC Holdings - all the paperwork is a result of the ownership structure

-

Ightenhill_Claret

- Posts: 389

- Joined: Fri Dec 30, 2022 4:14 pm

- Been Liked: 193 times

- Has Liked: 47 times

Post

by Ightenhill_Claret » Sat Oct 07, 2023 11:42 am

Thanks CP. why would an individual buy a single share for £88m? Or am I missing the point and this is an accounting mechanism?

-

Clive 1960

- Posts: 2056

- Joined: Tue Oct 18, 2022 10:15 am

- Been Liked: 299 times

- Has Liked: 568 times

Post

by Clive 1960 » Sat Oct 07, 2023 11:47 am

Ightenhill_Claret wrote: ↑Sat Oct 07, 2023 11:42 am

Thanks CP. why would an individual buy a single share for £88m? Or am I missing the point and this is an accounting mechanism?

just wait and see , we may never know who as invested if he or they don't want to be known, but hopefully some will be invested in January window especially up front.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 11:58 am

Ightenhill_Claret wrote: ↑Sat Oct 07, 2023 11:42 am

Thanks CP. why would an individual buy a single share for £88m? Or am I missing the point and this is an accounting mechanism?

It is not an individual buying a share in Kettering or Calder Vale it is Velocity Sports Ltd (Jersey) buying another share in Kettering Capital (it owns all the others) and Kettering buying a share in Calder Vale (it owns all the others) in essence makes no difference if it is 1 or 88 billion shares

The £88m we think has come from new investors in the ownership group - it could be one or it could be multiple - not from existing partners

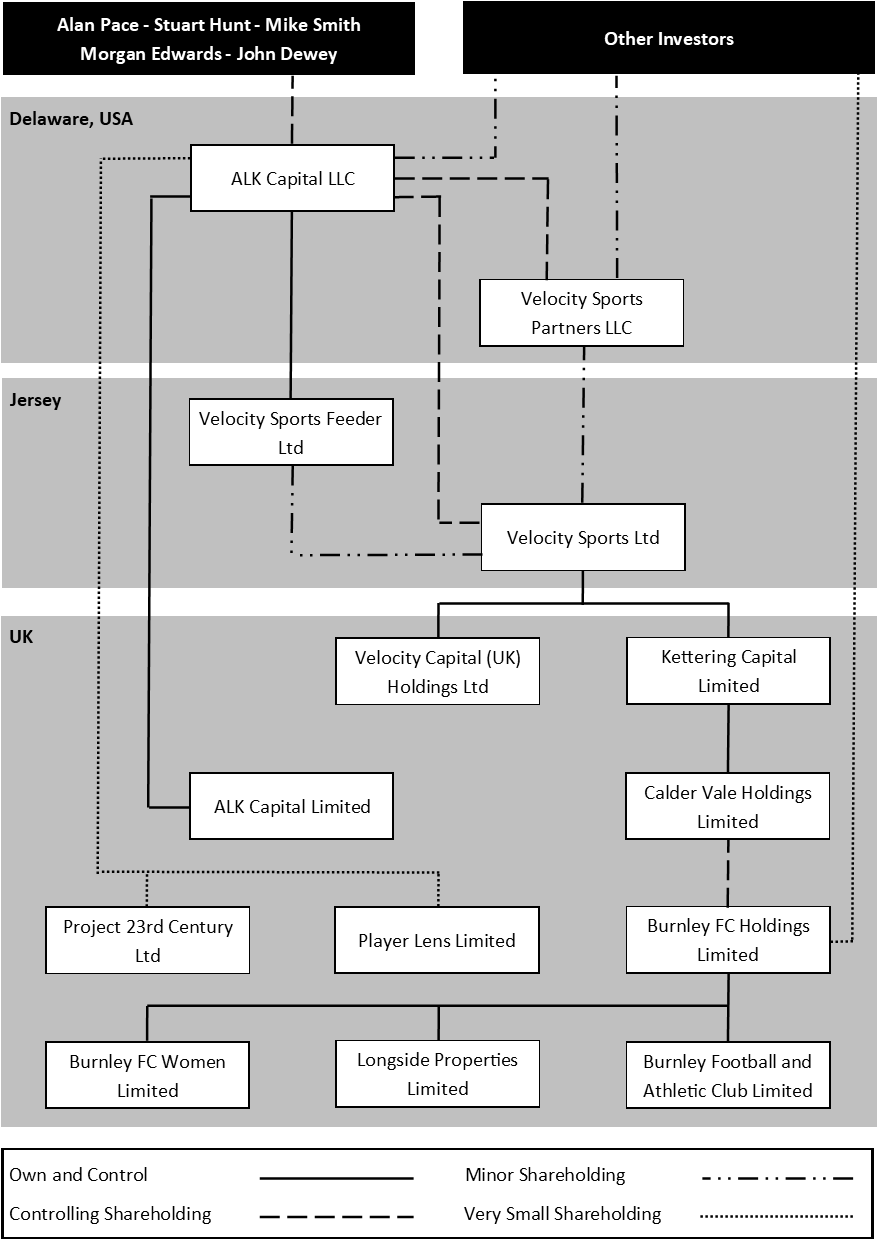

probably time to remind you of the structure again

New Shareholders in the ownership group appear to join the partnership of Velocity Sports Partners LLC which is controlled by ALK Capital LLC via and feeds into Velocity Sports Ltd (Jersey) which like every link in the chain is also controlled by ALK Capital LLC

- ALK Known Ownership Structure v 8.png (54.3 KiB) Viewed 4164 times

-

Ightenhill_Claret

- Posts: 389

- Joined: Fri Dec 30, 2022 4:14 pm

- Been Liked: 193 times

- Has Liked: 47 times

Post

by Ightenhill_Claret » Sat Oct 07, 2023 12:03 pm

That’s very helpful CP. Forgot just how complicated the ownership structure is.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 12:04 pm

Ightenhill_Claret wrote: ↑Sat Oct 07, 2023 11:42 am

Thanks CP. why would an individual buy a single share for £88m? Or am I missing the point and this is an accounting mechanism?

If you are interested my last article for the London clarets (current issue) was an update to this ownership structure as seen detailing what has been learned about the Jersey operations in particular

CT has a pdf of this which he is free to share with you if you ask him to send it to you

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 12:16 pm

Ightenhill_Claret wrote: ↑Sat Oct 07, 2023 12:03 pm

That’s very helpful CP. Forgot just how complicated the ownership structure is.

When you start looking at such ownership structures in modern football - ours is actually far from being the most complex, which is a sad state of affairs for the game as a whole

This user liked this post: Foshiznik

-

Paul Waine

- Posts: 10237

- Joined: Fri Jan 22, 2016 2:28 pm

- Been Liked: 2419 times

- Has Liked: 3339 times

Post

by Paul Waine » Sat Oct 07, 2023 12:17 pm

Chester Perry wrote: ↑Fri Oct 06, 2023 8:08 pm

it is not difficult to see

£10m from ALK/VSL used to buy shares in Kettering Capital and then used again to buy shares in Calder Vale Holdings in December 2020

£88m the borrowed from the club (£65m of which the club borrowed from MSD) which was used to buy shares in Kettering Capital in December 2020

a further £26.8m borrowed from the club by CVHL between January 2021 and July 31 2022 (giving a total of £114.8m borrowed from the club as stated by the club in its last accounts)

all of the above monies appear to have been used to pay for shares in the club

£88m from ALK/VSL (we assume) used to buy a share in Kettering Capital and then reused to buy a share in Calder Vale Holdings in late September 2023

that is well in excess of £200m passing through these companies in a little under 3 years (not all went through Kettering Capital I was just grouping them for convenience)

OK, you are adding monies coming into KCL/CVHL both from their shareholders, ALK/VS(US) and the monies borrowed from BFCHL. That does end up with big numbers. I'd suggest better to keep the two separate: money rec'd from shareholders and other money borrowed from BFCHL etc.

-

Ightenhill_Claret

- Posts: 389

- Joined: Fri Dec 30, 2022 4:14 pm

- Been Liked: 193 times

- Has Liked: 47 times

Post

by Ightenhill_Claret » Sat Oct 07, 2023 12:35 pm

Chester Perry wrote: ↑Sat Oct 07, 2023 12:04 pm

If you are interested my last article for the London clarets (current issue) was an update to this ownership structure as seen detailing what has been learned about the Jersey operations in particular

CT has a pdf of this which he is free to share with you if you ask him to send it to you

Thanks CP. @ClaretTony is it possible to share?

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 12:39 pm

Paul Waine wrote: ↑Sat Oct 07, 2023 12:17 pm

OK, you are adding monies coming into KCL/CVHL both from their shareholders, ALK/VS(US) and the monies borrowed from BFCHL. That does end up with big numbers. I'd suggest better to keep the two separate: money rec'd from shareholders and other money borrowed from BFCHL etc.

I was specific in saying monies that had passed through

-

Paul Waine

- Posts: 10237

- Joined: Fri Jan 22, 2016 2:28 pm

- Been Liked: 2419 times

- Has Liked: 3339 times

Post

by Paul Waine » Sat Oct 07, 2023 12:40 pm

Chester Perry wrote: ↑Sat Oct 07, 2023 12:16 pm

When you start looking at such ownership structures in modern football - ours is actually far from being the most complex, which is a sad state of affairs for the game as a whole

Hi CP, I disagree - maybe you would expect me to. The complex nature of the ownership structures are no more than a reflection of the international nature of the Premier League (and EFL to an extent) ownership groups. When BFCHL was owned by Mike Garlick, John B, Brian Kilby and others - yes, all "local boys" - the held their shares in a number of companies each of them owned: Clarets Go Large, Freight Investor Services etc. We didn't consider this to be complex because Mike Garlick, John B et al were all local businessmen and their companies that owned the shares were all UK companies registered at Companies House. However, add in owners from other countries and the companies that own their shareholdings will all start in one or more other countries - and those other countries quite commonly will have different financial disclosure rules and will always have different tax rules. So, Premier League football has gone international, both in the players signed by the clubs and by the possibility of ownership by foreign investors. Football is better for being international.

-

Paul Waine

- Posts: 10237

- Joined: Fri Jan 22, 2016 2:28 pm

- Been Liked: 2419 times

- Has Liked: 3339 times

Post

by Paul Waine » Sat Oct 07, 2023 12:42 pm

Chester Perry wrote: ↑Sat Oct 07, 2023 12:39 pm

I was specific in saying monies that had passed through

Yes, I know. But, you will have some on here thinking there's £200m knocking around waiting to be spent. I suggest keeping the pluses and the minuses separate so that it's easier to see and understand the balance between the two.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 1:04 pm

Paul Waine wrote: ↑Sat Oct 07, 2023 12:40 pm

Hi CP, I disagree - maybe you would expect me to. The complex nature of the ownership structures are no more than a reflection of the international nature of the Premier League (and EFL to an extent) ownership groups. When BFCHL was owned by Mike Garlick, John B, Brian Kilby and others - yes, all "local boys" - the held their shares in a number of companies each of them owned: Clarets Go Large, Freight Investor Services etc. We didn't consider this to be complex because Mike Garlick, John B et al were all local businessmen and their companies that owned the shares were all UK companies registered at Companies House. However, add in owners from other countries and the companies that own their shareholdings will all start in one or more other countries - and those other countries quite commonly will have different financial disclosure rules and will always have different tax rules. So, Premier League football has gone international, both in the players signed by the clubs and by the possibility of ownership by foreign investors. Football is better for being international.

Actually I wasn't expecting you to disagree - I think, given the ownership nature and the overseas element that it is almost as streamlined as is possible - when you look at some others that are out there the structure they have is much more complex and has many, many more nodes/companies within it

This user liked this post: Paul Waine

-

Ightenhill_Claret

- Posts: 389

- Joined: Fri Dec 30, 2022 4:14 pm

- Been Liked: 193 times

- Has Liked: 47 times

Post

by Ightenhill_Claret » Sat Oct 07, 2023 1:11 pm

PW or CP - is there ever a requirement to reveal who this investment has come from (either an individual or a group of individuals) under PL rules/UK financial rules?

Or does the fact that the money comes in via a US company into a Jersey-based company and then into the UK company mean that the initial investment (however sizeable) is far enough removed for it to be revealed?

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 1:36 pm

Ightenhill_Claret wrote: ↑Sat Oct 07, 2023 1:11 pm

PW or CP - is there ever a requirement to reveal who this investment has come from (either an individual or a group of individuals) under PL rules/UK financial rules?

Or does the fact that the money comes in via a US company into a Jersey-based company and then into the UK company mean that the initial investment (however sizeable) is far enough removed for it to be revealed?

The FA/PL/EFL need to know who the major shareholders are (10% or more i think) - that can remain out of the public domain for the most part though there is a requirement for this kind of statement about who holds overall control

https://www.burnleyfootballclub.com/company-details

that said the one above was last amended in September 2021 and has been out of date since the shares were purchased from the small shareholders in March 2022

Companies House requires a confirmation statement about who the shareholders are every year and this must include the name of those who maintain control of the company as owners

-

Ightenhill_Claret

- Posts: 389

- Joined: Fri Dec 30, 2022 4:14 pm

- Been Liked: 193 times

- Has Liked: 47 times

Post

by Ightenhill_Claret » Sat Oct 07, 2023 1:55 pm

But essentially can the ‘shareholder’ on the UK firm be a company (so in this case the Jersey outfit?) as opposed to every individual with a specific shareholding in the company?

Apologies for all the questions - I’be always been OK with interpreting profit and loss sheets etc for stories but not the more complex stuff.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 2:12 pm

Ightenhill_Claret wrote: ↑Sat Oct 07, 2023 1:55 pm

But essentially can the ‘shareholder’ on the UK firm be a company (so in this case the Jersey outfit?) as opposed to every individual with a specific shareholding in the company?

Apologies for all the questions - I’be always been OK with interpreting profit and loss sheets etc for stories but not the more complex stuff.

Yes it can be a company or multiple companies - The FA/PL/EFL will still need to know who the major shareholders in these entities are - from a Companies House perspective the confirmation statements are still required

So

at Kettering Capital it is 100% owned by Velocity Sports Ltd (Jersey) Alan Pace is declared as the person with significant control the other directors being Stuart Hunt and Michael Smith

At Calder Vale Holdings it is 100% owned by Kettering Capital Alan Pace is declared as the person with significant control the other directors being Stuart Hunt and Michael Smith

Calder Vale Holdings is the entity that holds all ALK/VSL shares in Burnley FC Holdings

This user liked this post: Ightenhill_Claret

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 2:40 pm

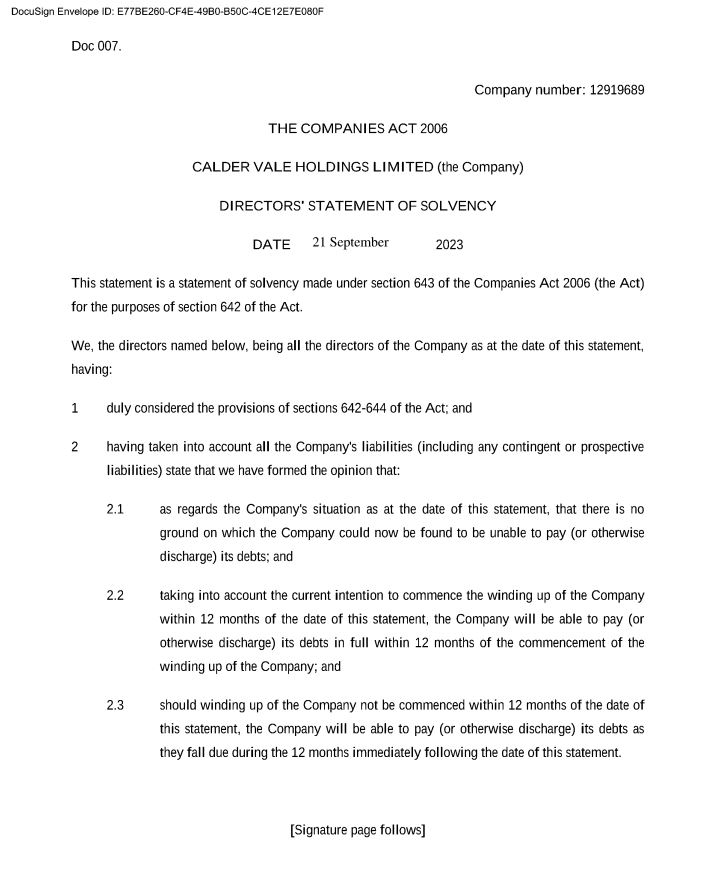

So

it is well worth reading the newly published solvency statements for Kettering Capital and Calder Vale Holdings in full. It appears that there is an intention to wind up both these companies within 12 months

- CVHL Solvency statement.JPG (84.61 KiB) Viewed 3908 times

which leaves a few questions

is the ownership structure going to change - perhaps the Burnley FC Holdings shares being owned and controlled by the recently formed Velocity Capital (UK) Limited?

is the club in the process of being sold, in stages?

whatever the case if the intention is to dissolve Calder Vale Holdings then it must first settle its outstanding debts with Burnley FC Holdings Limited and Burnley Football and Athletic Club Limited - it could be the case that this is what the £88m is for

^^^^ I am more than open to this understanding of a winding up intention being rubbished by those who know these things better than me

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 2:56 pm

That should be Velocity Capital (UK) Holdings Ltd

-

Clive 1960

- Posts: 2056

- Joined: Tue Oct 18, 2022 10:15 am

- Been Liked: 299 times

- Has Liked: 568 times

Post

by Clive 1960 » Sat Oct 07, 2023 2:57 pm

Chester Perry wrote: ↑Sat Oct 07, 2023 2:40 pm

So

it is well worth reading the newly published solvency statements for Kettering Capital and Calder Vale Holdings in full. It appears that there is an intention to wind up both these companies within 12 months

CVHL Solvency statement.JPG

which leaves a few questions

is the ownership structure going to change - perhaps the Burnley FC Holdings shares being owned and controlled by the recently formed Velocity Capital (UK) Limited?

is the club in the process of being sold, in stages?

whatever the case if the intention is to dissolve Calder Vale Holdings then it must first settle its outstanding debts with Burnley FC Holdings Limited and Burnley Football and Athletic Club Limited - it could be the case that this is what the £88m is for

^^^^ I am more than open to this understanding of a winding up intention being rubbished by those who know these things better than me

just wait and see because none of us know what's happening only Pace and board members , the only thing we know is 88 million as bought a share .

-

Paul Waine

- Posts: 10237

- Joined: Fri Jan 22, 2016 2:28 pm

- Been Liked: 2419 times

- Has Liked: 3339 times

Post

by Paul Waine » Sat Oct 07, 2023 4:08 pm

Chester Perry wrote: ↑Sat Oct 07, 2023 2:40 pm

So

it is well worth reading the newly published solvency statements for Kettering Capital and Calder Vale Holdings in full. It appears that there is an intention to wind up both these companies within 12 months

CVHL Solvency statement.JPG

which leaves a few questions

is the ownership structure going to change - perhaps the Burnley FC Holdings shares being owned and controlled by the recently formed Velocity Capital (UK) Limited?

is the club in the process of being sold, in stages?

whatever the case if the intention is to dissolve Calder Vale Holdings then it must first settle its outstanding debts with Burnley FC Holdings Limited and Burnley Football and Athletic Club Limited - it could be the case that this is what the £88m is for

^^^^ I am more than open to this understanding of a winding up intention being rubbished by those who know these things better than me

Hi CP, Solvency Statement is a Companies Act requirement that permits the company making the statement to reduce share capital. It's not an indication that the directors are considering winding the company up. The statement says "

IF the company is wound up within 12 months of the statement...

It doesn't mean the directors are planning to wind up either Kettering or Calder Vale

-

spt_claret

- Posts: 2077

- Joined: Sat Sep 03, 2016 6:52 pm

- Been Liked: 815 times

- Has Liked: 484 times

Post

by spt_claret » Sat Oct 07, 2023 4:18 pm

Chester Perry wrote: ↑Fri Oct 06, 2023 11:50 pm

add

Bahrain

Kuwait

Iraq

Qatar

Interestingly Kuwait's public investment fund is much bigger than that of Saudi Arabia

Got absolutely no club info but I have a friend who works for Bapco in Bahrain and was involved in the discovery of an enormous oil reserve a few years ago. If they can start extracting it they'll become a player overnight on the global market, but I wouldn't expect to see investment in football coming just yet.

Iraq would surprise me, unless AAD has particularly raised our profile there.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 4:32 pm

Paul Waine wrote: ↑Sat Oct 07, 2023 4:08 pm

Hi CP, Solvency Statement is a Companies Act requirement that permits the company making the statement to reduce share capital. It's not an indication that the directors are considering winding the company up. The statement says "

IF the company is wound up within 12 months of the statement...

It doesn't mean the directors are planning to wind up either Kettering or Calder Vale

Whish was exactly my first impression on reading this, however when I revisited it some time later I found that the word

'if' is not to be found anywhere on this statement - which is why I posted and was very open to being refuted given it looked so boilerplate like

-

Paul Waine

- Posts: 10237

- Joined: Fri Jan 22, 2016 2:28 pm

- Been Liked: 2419 times

- Has Liked: 3339 times

Post

by Paul Waine » Sat Oct 07, 2023 5:07 pm

Chester Perry wrote: ↑Sat Oct 07, 2023 4:32 pm

Whish was exactly my first impression on reading this, however when I revisited it some time later I found that the word

'if' is not to be found anywhere on this statement - which is why I posted and was very open to being refuted given it looked so boilerplate like

Yes, I'm reading HMRC and various legal firms' commentaries on Solvency Statement. Agree, reading the docs that Kettering have submitted it doesn't say "if." Of course, it does state "should winding up of the Company not be commenced within 12 months..."

I wonder if the Solvency Statement requirements have been strengthened - it must both say "taking into account the current intention to commence the winding up..." and "should winding up of the Company not be commenced within 12 months..." - so, it's extremely clear that all the directors have considered the liabilities the company has and is able to confirm the resources exist to meet all these liabilities.

-

Chester Perry

- Posts: 20226

- Joined: Thu Jun 02, 2016 11:06 am

- Been Liked: 3307 times

- Has Liked: 481 times

Post

by Chester Perry » Sat Oct 07, 2023 5:16 pm

Paul Waine wrote: ↑Sat Oct 07, 2023 5:07 pm

Yes, I'm reading HMRC and various legal firms' commentaries on Solvency Statement. Agree, reading the docs that Kettering have submitted it doesn't say "if." Of course, it does state "should winding up of the Company not be commenced within 12 months..."

I wonder if the Solvency Statement requirements have been strengthened - it must both say "taking into account the current intention to commence the winding up..." and "should winding up of the Company not be commenced within 12 months..." - so, it's extremely clear that all the directors have considered the liabilities the company has and is able to confirm the resources exist to meet all these liabilities.

there is 2,2 in the image I posted earlier which talks of a current intention to wind up - which appears in itself quite definitive, but I remain open to being persuaded either way